A financial expert has outlined the essential pension inquiries individuals should pose to themselves, as recent studies indicate a growing trend of utilizing social media for personal finance guidance.

The latest research conducted by AYTM, on behalf of TikTok, indicates that one out of every three UK users now leverages the platform to educate themselves on financial matters, with 41% encountering banking-related content on their feeds.

Utilizing TikTok as a platform to engage with Gen Z audiences, Scottish Widows has amassed over 323 million video views since September 2024, with more than 191,000 posts tagged under #retirementplanning.

Major financial institutions like HSBC and Nationwide have also reported significant success in engaging users with personal finance content on TikTok, garnering over 10 million views collectively.

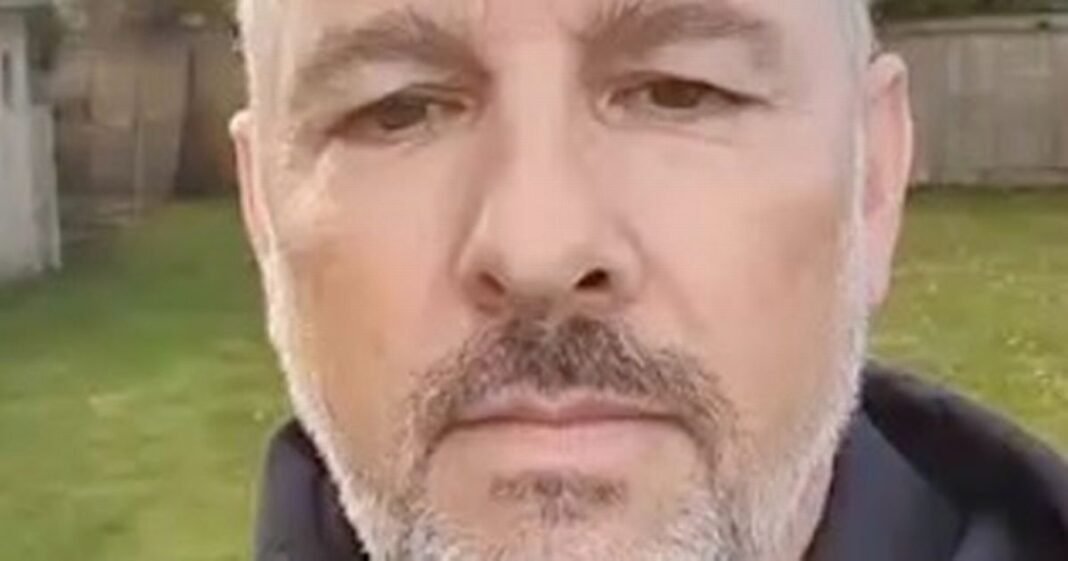

Robert Cochran, a pensions specialist at Scottish Widows, has shared valuable insights with Mirror readers, offering tips for those struggling to kickstart their pension journey or seeking to optimize their retirement savings.

In the quest for financial security in retirement, it is common for individuals to amass multiple pension pots throughout their careers, potentially leading to difficulties in tracking their savings.

To address this challenge, Robert advises individuals to proactively reach out to their pension providers to ascertain the current status of their savings. Moreover, he recommends utilizing the pension tracing service available on GOV.UK to effectively manage and reunite with any lost retirement funds.

Furthermore, Robert suggests leveraging pension provider apps to monitor private and workplace schemes, along with regularly checking state pension forecasts through HMRC’s app to stay informed about future income streams in retirement.

Understanding the envisioned retirement lifestyle is crucial, with the Pensions and Lifetime Savings Association categorizing retirement standards into three tiers – minimum, moderate, and comfortable – each associated with varying annual costs.

For those falling short of their desired retirement lifestyle, Robert advocates for increased contributions to workplace pensions, emphasizing the benefits of employer-matched contributions under auto-enrollment schemes.

Consolidating multiple pension pots into a single plan is another strategic move recommended by Robert to streamline pension management and potentially reduce costs. Evaluating existing fees and exit charges is essential before making decisions regarding pension consolidation.

In conclusion, by diligently tracking and optimizing pension savings, individuals can pave the way for a more secure and comfortable retirement.